The End of the Era of the Dollar as the World’s Reserve Currency

The status of the USD as the world’s reserve currency has been a cornerstone of the global economy for decades. However, recent geopolitical and economic developments have raised concerns that the era of the dollar may be coming to an end. The US has increasingly used its dominant position to impose sanctions on other countries, weaponizing the dollar in the process. This has led many nations to seek alternative means of conducting international trade, such as barter or using other currencies like the euro, yuan, or even cryptocurrencies. The trend is a worrying sign for the US economy and the global financial system as a whole, as it could lead to a loss of confidence in the dollar and trigger a crisis of confidence.

Changing geopolitical landscape: rivals and former allies moving away from the dollar

The situation is compounded by the changing geopolitical landscape. Countries such as Russia and China, which have traditionally been viewed as rivals to the US, are increasingly asserting themselves on the global stage, challenging American hegemony. At the same time, other nations, including former allies and neutrals, are also moving away from the dollar, seeking to protect themselves from the risks associated with its use as a weapon. India, for example, has been buying Russian oil and conducting transactions in rupees, while Saudi Arabia and Iran have cooperated with China as a mediator, bypassing the dollar altogether.

Ron Paul’s views on the matter are relevant here. He has long advocated for the US to stop instigating conflicts and to focus on mutual interests and trade rather than conflict over forms of government. By following these policies, Paul believes the US could have avoided the current situation, where many countries are seeking to move away from the dollar as the world’s reserve currency. If the US had pursued a more cooperative approach to international relations, it could have maintained the dollar’s dominance as the world’s reserve currency.

Consequences of a shift away from the dollar

The consequences of a shift away from the dollar could be far-reaching. The US economy is heavily reliant on the dollar’s status as the world’s reserve currency, with around two-thirds of all foreign currency reserves held in dollars. A loss of confidence in the dollar could lead to a sharp decline in demand for US treasuries, making it more difficult and expensive for the government to borrow money. This could trigger a financial crisis, with ripple effects felt around the world. The US would also face a loss of influence on the global stage, as the dollar’s dominance has given it significant leverage in international affairs. The future of the dollar, therefore, is a matter of concern not just for the US but for the entire world.

The End of Small Websites and Blogs? What AI Means for the Future of Content.

AI Embedded in Search will Hurt Contentmakers

Here’s one thing about ChatGPT and these AI chatbots. They learned all they know from the internet, scraping articles from one food blog here, and one content website there. Once ChatGPT returns results directly from these content sites the content sites will no longer receive money from ads on their sites or through purchases of their product (or at least that will be diminished).

The release of ChatGPT into Bing and LaMDA into Google may result in the “dumbing down” of the internet as we know it, and could very well make one opinion or one popular version of the truth the only version that get’s put out there.

When you Google something, the PageRank system does something similar. However, you still get pages and pages of options for you to browse. You can use additional words, exclusion rules, and date ranges to filter data. You get a buffet of websites managed by different people, just like you get many books about the same topic in a library. The future likes it may be replaced with you getting your information from a single source, that in itself should be scary to people.

Who Benefits?

Online “Communities”

Who does this benefit? It actually, in my opinion, benefits online forums and places like Nextdoor and Facebook. People may opt to ask questions of their friends, neighbors in favor of AI generated mass plagiarism. Since the AI has been feed at least 45 terabytes of text, I’m not saying it’s going to become dumb overnight – it will take months and probably years of it being in production. Over time the revenue streams of small to medium to large websites will decay as AI envelops new areas. For example, Kelly Blue Book data will become obsolete as Bing and Google format the data for these types of websites in such a way that you no longer have to click into the website.

Some may push back. Big websites as the Wall Street Journal and CNN have already added paywalls to counter news aggregators. However, the vast majority of people will not feel the need to pay for subscriptions to websites, and those companies that block their content will just become irrelevant.

Creative Thinkers

Another area that probably will benefit from this are the people who think outside the box, meaning the creative ones that will be able to put together knowledge in ways other people will rely on AI to take care of in the future. Critical thinkers may be able to anticipate macroeconomic trends beyond what they are spoon fed by Cramer, Charles Schwab, etc.

On the flipside, I also see AI benefiting those who don’t know what they’re doing at all. However I only see this benefit as temporary and unlikely to be sustainable – they will be susceptible to conditions that aren’t expected or normal, and depending on the way they rely on AI they may not be able to react correctly. Instead of using problem solving and situational awareness, those reliant on AI should be expected to follow a pattern established by the AI based on the most popular content.

The “Truthmakers”

Now this category takes a darker turn. The truthmakers are those who run these AI programs and can tweak them to meet their needs. If you try to search sensitive subjects in ChatGPT now you typically will get a “I can’t respond to this kind of question” type response. Alternatively, you will get the most politically correct response based on the coders discretion.

Here’s an example of a response that was really carefully put together. As you can see, there is no mention of what folks on the right side of the aisle would say about the subject. There is the part about the need to proper them safely – something no one would argue over.

Let’s go through another question: “Which country has the best food?”

Now I asked this question twice with small variation and got two different answers. However both were prefaced with the sort of blanket disclaimer that you’ll see on most answers that are subjective. This sort of weak response is typical even for as benign topics as food.

The Future of this Blog

What’s going to happen to thehighestreturn.com ? I’m not planning on leaving anytime soon. This is more of a hobby for me and has never been profitable. I’ve already shut down my other domains and am just running on this one. Please put your email address in to subscribe to my newsletters!

Very Clique, Very True – Invest in Yourself

Invest in Yourself

So I’m sure you’ve heard this more than a dozen times. One of the best investments you can make is in yourself. I’m not talking about your clothes, your phone, car, etc. I’m talking about your skills and health. Oftentimes your skill level is restricted by your level of health, so those are tightly coupled.

Regardless of macroeconomic conditions, folks that can add value to society will enjoy a level of comfort beyond those who cannot if you take away everything. If you take away all wealth through a Weimar Republic style inflation, you’ll find that folks who are capable are generally better off than those who aren’t.

A lousy stockmarket, market or currency manipulation cannot take knowledge out of your brain or remove your experiences.

Where to Invest Your Time

Time is the biggest cost when it comes to investing in yourself. True, college tuition is measured in dollars, but the true investments that are most valuable are experiences and skills that can be obtained with an internet connection and a display. I challenge any of you to comment below with a skill that cannot be freely obtained. Other pieces of knowledge should be obtained trying to increase your assets. For example, learn more about real estate as you acquire more investment properties. Learn more about how to deal with people as you make hard mistakes and get burned. If you could learn to avoid these pitfalls, that’s great! If you don’t then as long as the mistake doesn’t completely destroy you, you should take that as a learning opportunity.

Austerity for the Government and You

Painful but necessary. I’m talking about the United States Federal spending. Instead of choosing constituent classes to give free money to that comes from the wider population, it’s time now to reduce spending across the board.

Start with Foreign Spending

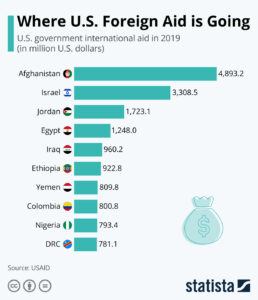

Starting with non-constituents, meaning foreign entities – foreign countries, organizations, etc. The Federal Government, whose job it is to represent US citizens, needs to reduce foreign aid spending.

There’s a really good website that breaks down foreign assistance by country called “ForeignAssistance.Gov” – it’s located at https://foreignassistance.gov/cd

You’ll find that four countries almost or exceeding a billion USD in US aid each year, including:

- Afghanistan

- Israel

- Jordan

- Egypt

- Iraq

- Ethiopia

- Yemen

- Columbia

- Nigeria

- Lebanon

Less USD in circulation means less spending and less inflation. Countries will learn to be self sufficient, and less needy on external income coming in to keep them going. If we’re lucky other foreign competitors will prop up these countries and deplete their own cash reserve. Regarding the Ukraine spending, the US is on track to donate almost 100 billion dollars. So far total US aid to Ukraine has been more than 68 billion. [1]

Without getting into whether the spending is “right” or “wrong”, I think it’s objectively fair to say we’re treating Ukraine better than we did the UK back in WW2. Back in WW2 at least we had the UK send us gold and create loans for the material we were sending over. A much more prudent policy that keeps American interests in view.

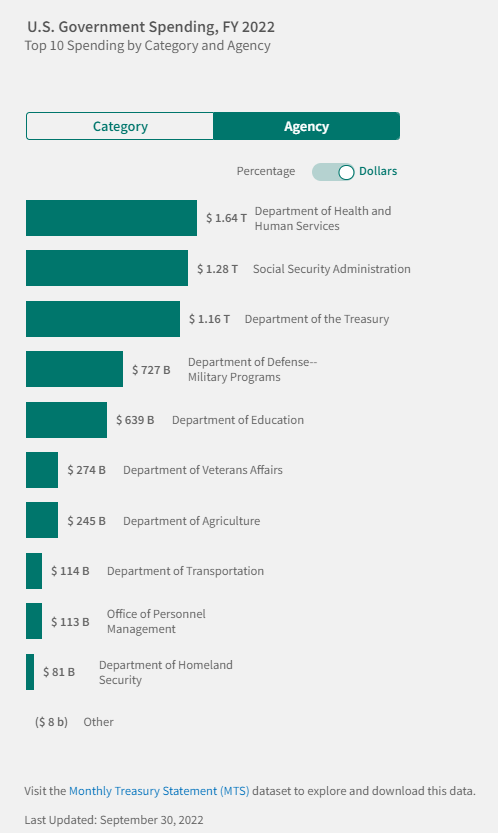

Domestic Spending

Social Security, Healthcare, and many branches of the Federal government spend a lot of money on non-essential workforce. Also, much of that money is spent towards pension plans that the rest of the economy does not have the luxury to have – you can check out more details about government pension eligibility here at https://www.opm.gov/retirement-center/fers-information/eligibility/. Long story short, as the size of government grows so does the residual costs. Unlike the free market, government agencies do not have to prove they are effective, as free market businesses do. They don’t even have to effectively carry out their mission, because there are no other competing agencies to compare against. At the state level, at least different states can compare their effectiveness in carrying out services against other states.

While it’s hard to simply say we need to cut Social Security and Medicare spending, or Military spending, it is a question that needs to be brought up. It’s a political landmine but I think what needs to happen is each of these behemoths need to be objectively inspected completely to ensure that wastage is kept to a minimum. I see technology and analytics as a good means of really proving out the effectiveness of these agencies each and every one.

Personal Spending

The US Government is probably not the only entity that needs to cut on spending. Readers should also consider cutting the fat if they can help it while staying sane.

US personal spending is a double edged sword. Without a lot of domestic spending the economy will be damaged and there will be less money in circulation. However, increased domestic spending generally tends to result in higher prices because of more demand than supply. Higher inflation is the reason the Federal Reserve increased interest rates, and further interest rate increases will harm the stock market. While technically higher interest rates were long overdue, they come at a time when the economy and it’s companies are addicted to cheap loans. You will find that many of these companies that were overly dependent on this cheap money will start to go out of business.

What Should I Do?

For those reading this, I’d encourage you all to refrain from frivolous spending and continue to focus on spending money on assets rather than liabilities. Given the volatile nature of the stock market in relation to interest rates, I’d suggest holding a healthy chunk of cash in a high yield savings account. I’m currently getting 3.3% interest on my savings account holdings, and at least 2% cash back on credit card purchases. The Citi Double cash card gives me 2% back on everything and I use an Amex card to get 5% back on groceries. Spending less by choosing carefully where to shop adds up in the long run. Walk more and try to do activities that don’t require cash that are still fun.

My best guess estimate about when the stock market and real estate market start to gain ground again is when the Federal reserve stops raising interest rates and starts lowering them again – It may be late this year or may be up to three years from now.

Citations

[1] “Aid to Ukraine Explained in Six Charts.” Aid to Ukraine Explained in Six Charts | Center for Strategic and International Studies, 9 Jan. 2023, https://www.csis.org/analysis/aid-ukraine-explained-six-charts.

Subscription Based Products are in Trouble

Some Companies Are Losing Customers as the 2022 Recession Hits

Netflix, Hulu, Spotify, and others are all in trouble. People are cancelling and holding off on discretionary goods, and accumulating cash as the recession drags on. They’re doing this because inflation is up, and the stock market is down. It’s only a matter of time before lower stock prices translate into the reality of less jobs. You see, the stock market is an Oracle of what is to come. You have the brightest minds, AI, all making decisions off of all known information. What the stock market is telling us is that bad things are in store for our economy in the future. You could argue that interest rates are a denominator when it comes to calculating stock prices – this is a correct. However the stock declines have not been the same for all sectors.

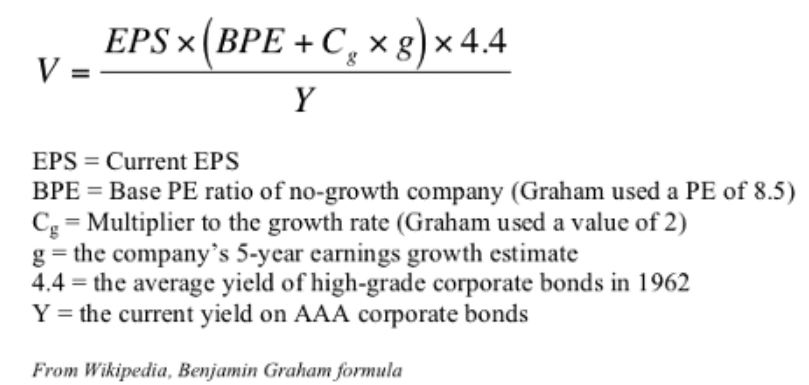

Ben Graham original formula

Some Companies Will Keep Subscribers

Now I think companies that offer tangible financial benefits to their subscribers will keep them. Amazon will keep their Prime customers, since you can easily save the cost of a subscription through a few orders without paying shipping. Another example is Apple Music, by this point folks who listen to Apple music are likely engrained in the Apple ecosystem. It would be a large pain for these Apple Fans to leave the ecosystem or start to pay for music on an ad-hoc basis. Apple pretty much has them tied for life. Costco is another good example of a company that saves members on bulk purchases, and offers high quality store brand products – in fact I wouldn’t be surprised if MORE people get subscriptions as recession hits home.

What Stocks I Prefer

If I had to make a chose between rivals, one at a time, here is my list of my winners and losers:

- Netflix vs Amazon – Amazon!

- Disney Plus vs Amazon – Amazon!

- Spotify vs Apple – Apple!

- Fitbit vs Apple – Apple!

The 2022 Depression

Well, it’s been about a year since my last post. A lot of things have changed for me, a new job with unique challenges and opportunities, an expanding family, and lastly a move from one state to another. That being said, I do feel like I’ve abandoned my subscribers and for that I’m sorry!

Now that that’s out of the way I’d like to recap for you what I think has happened so far this year and what you can do to situate yourself financially to make the best return on your investments.

Inflation

It’s become clear that the media and the political elite have really been shocked at the rate of inflation over the past couple years – the official numbers are drastically underreported yet are still shockingly high.

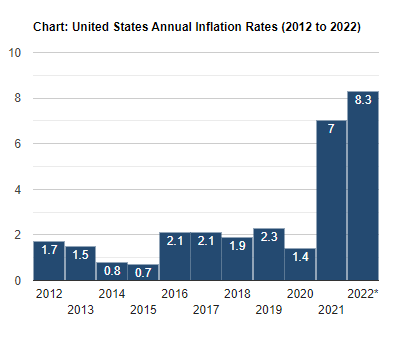

The chart and table below display annual US inflation rates for calendar years from 2000 and 2012 to 2022 ending in August 2022.

Now I have my own metrics of calculating inflation, that being the price of a Michelina’s frozen Entrée. You’ll find this in the freezer section of any major supermarket. Now I know the prices for these things had been $1 each for the longest time. Last year the price went to $1.30 and this year they cost $1.69 at the same place (Walmart). Other stores charge even more… So if you are gauging inflation based on food cost if you’re diet consisted only of these then the inflation rate is closer to 30%.

Baby Boomers in Trouble

Now on a more serious note, of the around 72 million Baby Boomers in the US, the older spectrum are now in their early 70’s. The mandatory 401k Withdrawal age in 2022 is 72 (it used to be 70.5). That means we will start to see outflows from the largest population group in the US, and potentially more voluntary withdrawals as it doesn’t make sense to for Baby Boomers to hoard cash if they are in end of life stage. This means either the Federal Reserve is going to allow the stocks to be tanked by their higher interest rates and destroy the quality of life for millions of the older generation and make them reliant on government benefits OR go back to purchasing stocks and putting the brakes on interest rate hikes.

Quiet Quitting

The quiet quitting movement is here, and it’s loud. This is not just happening in the US but also throughout the world in developed or developing countries – in China this is called the “lie flat” movement. As someone who has been to Europe, this is already the norm in countries like Italy and France – but as it becomes normalized in the US and China the entire world could become less productive. Less productivity could result in higher prices for goods and services. As long as you’re in a position where you’re income can scale with inflation you should be ok, but for those that can’t it will be important to have job mobility. For retirees this is just a bad situation altogether.

What I’m Doing

Now to the meat of the article – what am I doing to situate myself where I’m not blown away by the coming events. First thing, I’m holding the stocks in good long term companies. My portfolio is heavier in defense, food production, and Apple stock. I see Apple as an industry in itself since it has put itself in a good position against companies who leeched off of people’s private data (I won’t name names and get demonetized). Secondly, Apple is second against none ever since it surpassed Intel in making the best phone processors. Lastly, Apple has tons of cash reserves in USD so a strong dollar isn’t as bad as you may think for this company. Food stocks have done pretty well since the war in Ukraine, same with defense stocks. Both of these are also things that people and governments will not stop spending money on. In fact, a larger proportion of money is spent on these sectors during times of world tension like we see today.

Less Discretionary Spending

You will not see me going near buying discretionary spending companies like Build a Bear with a 10 foot pole. In fact I have purchased put options on this and other frivolous retail companies. In times of depression you’ll still see a lot of people in supermarkets but very few people in Coach stores. Middle class luxury items are getting and will continue to get quashed for the next year at least in my opinion.

I’m also holding stock in Chevron, as energy prices stay high. The biggest risk to oil stocks are political actions against them by the current administration. They can pick winners and losers, and its a risk you have to evaluate as you hold companies that can be construed as controversial. If you went back 40 years ago you would probably not have believed if the government and regulations could kill the tobacco industry, but it happened. This time the focus is on fossil fuels – the recent conflicts and the necessity for energy has probably drawn attention away from these companies temporarily.

Preparing to Strike

Cash is important to hold in your portfolios, and people often call this “powder” for a reason, it gives you ammunition to get in when prices are routed in stocks and real estate. If real estate gets down to a level where I can reach my 1% to 2% rule on real estate returns I will probably buy another rental property. I will attempt to lock in a 30 year fixed rate but this all depends on what the mortgage and escrow costs are in comparison to my expected rental income.

Will I Keep Writing?

I’m hoping to write at least once a month from here on out. The major changes in my life didn’t need to put a stop to my posts, I just need to be more consistent. I’m still pretty active on my Facebook groups and pages.

References and Relevant Links

What if all Governments ban Bitcoin?

To me it’s silly to ban bitcoin, but history and other countries have shown that banning a useful money that holds its value is often the course domineering governments take to meet their ends. China and India come to mind when it comes to banning cryptocurrencies or even certain higher denominations of their paper money. However, there is a spectre that other countries that are purportedly free market will also follow suit. This hard cutoff supposedly will coincide with the release of CBDC’s, or Central Bank Digital Currencies. If we want to see how this might play out it may be worth looking to the past.

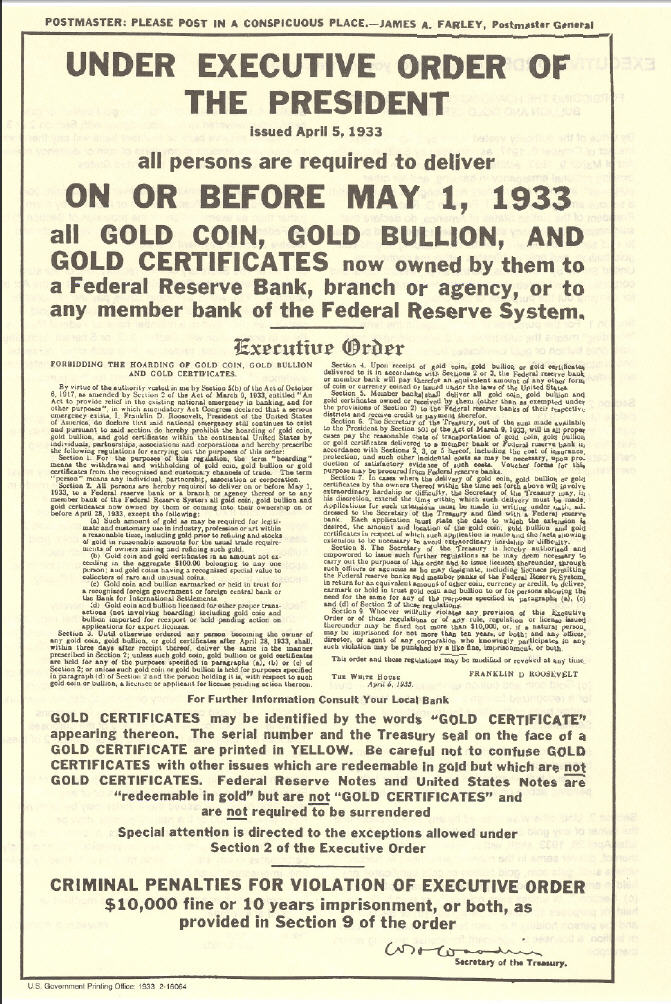

In 1933, four years into the Great Depression, FDR enacted executive order 6102 (image below) which required all persons to deliver on or before May 1, 1933, all but a small amount of gold coin, gold bullion, and gold certificates owned by them to the Federal Reserve in exchange for $20.67 per troy ounce. It would not be until 1974 that private citizens could once again own gold. The reason for this executive order was to stimulate the economy by being able to increase money supply which was at the time backed by a gold standard. By 1974, of course, the US was no longer really on a gold standard since three years earlier in 1971 Nixon permanently ceased the convertibility of the US dollar to gold by foreign countries. At that point the US had created way more dollars than it had gold to back them, and if all the dollars were redeemed for gold at their fixed price the point at which no more gold existed the financial system at the time would collapse. For those who held onto their gold either illegally or having had jewelry or numismatic coins (which were exempt from the confiscation in 1933), they would have seen the value rise tremendously – and most likely have been able to sell their gold in countries where it was not illegal to hold.

The same goes for bitcoin in the countries that have banned it. Online it is pretty easy to find someone who would be able to transfer money if you send bitcoin, and if you have a hardware wallet and didn’t want to transact online but needed to sell bitcoin one method is to leave the country to do so.

What is interesting to me is that bitcoin and cryptos are being targeted but real estate and other assets are not – wait, that’s not true either! Certain countries are cracking down on mom and pop real estate investors by now making it harder to get investment properties. This could be in the form of bans on owning over X amount of properties, or introducing new punitive taxes to discourage buying properties as investments. Now wait a second, stocks are still available to purchase, aren’t they? Yes, they are – and if inflation is 10% per year and your stocks go up 10% a year you are effectively keeping your net worth the same until you sell and pay taxes. What about gold? In the digital age of Amazon gold and silver, in my opinion, have been overlooked as stores of value. That being said, most young people would not accept gold/silver for cash since it is so foreign to them. They’d probably value an unopened bar or chocolate more than a silver bar (see video).

Ultimately, it will be a real test of Democracy and the free market to see which countries do not ban cryptocurrencies. Buying them is not being forced on anyone, and banning them will take away the hope millions have put into get themself closer to financial security or financial freedom.

I really hope the US does not go the way of more authoritarian countries in banning the future of money for their own hyperinflating unit that gets created in the trillions without the consent of the people who earn dollars for a living.

Inflation is More than Just Money Printing

The inflation we are experiencing in the United States is more than just money printing. It is because of herd mentality here in the States compounded by a growing lack of trust in the US Dollar abroad.

Demand for Benjamins Abroad

When I lived in Malaysia, each weekend there was a line that stretched for at least a few dozen people at a mall named Mid Valley in heart of Kuala Lumpur. That line was people exchanging their local currency – the Malaysian ringgit, into US Dollars. They did so to preserve purchasing power since their local currency was being devalued due to their country’s dependence on oil production for their economy. You see, when the US dollar is the world reserve currency it tends to preserve its power since everyone wants to collect them and not necessarily spend them. Imagine if everyone in the world was doing the same, and not just the mom and pop citizens but also entire governments!

This action takes circulating USD out of circulation at least temporarily, and demand of this nature makes the USD stronger versus the currency that are being exchanged out of. Even though both the US and Malaysia were making fiat (and I’m not talking about the poorly made cars) paper currency, the US benefits from strong demand from other countries continuing to prop up the dollar and wanting to sell their goods for dollars.

Herd Mentality Causing Price Spikes at Home

Now if you tune into CNN or some other popular news channel you will be told that price hikes have to do exclusively with ports being backed up due to Covid related worker shortages – this is not the whole story. Demand for goods is higher, and the desire to hoard goods hasn’t completely gone away from more than a year ago (remember when everything was rationed?). If you go to the local Costco or Sams Club here in Albuquerque they are still limiting the number of bottle water packs you can buy to two or three, people seem to still be being more toilet paper than normal, and there are folks who are already finishing up their Christmas shopping for fear of items not being available or being much more expensive come December. This spending is what I like to call velocity of money in motion, and is causing prices to go up on main street.

What about Real Estate?

The cash that the Federal Reserve created months and years ago had already funneled into the financial system first and caused companies flush with cash to go for asset buying sprees, such as real estate. Big companies like OpenDoor and Zillow bought homes over their value, in anticipation of “flipping” them and making money purely from the upward price trend that was happening since mid 2020. The only problem is individuals stopped receiving stimulus checks and companies started opening up and wanting people to get back to work – slowing down the home buying and turning the rising price trend around if even slightly.

I wholeheartedly expect home prices to fall in the hottest areas this winter, but I do think the fall will be short-lived as moderate inflation catches up. People will start to demand higher wages and the most profitable industries will be able to provide them. Industries that cannot adjust their prices very much to keep track with inflation will suffer, and their employees will suffer with stagnant wages. I expect the agriculture industry to come out of this better than before, same with companies that sell inelastic goods such as food and modest housing. Luxury housing will suffer along with luxury good industries.

What can I do?

Go back to my blog and read the article titled “How To Preserve Your Assets During 1970’s Style Inflation?”

Make sure your income keeps up with inflation, pivot to make that happen. Make sure you have skills that are in demand that are well compensated for if you’re starting out, and if you already have assets make sure they are cash flowing. Having debt during high inflation is a great thing as long as your income keeps up with inflation. For example, if you own a rental property and pay a 30 year fixed rate mortgage ideally you’ll be able to adjust your rent for inflation.

Bottom Line

Inflation is not transitory in that it will return to what it was before Jerome Powell’s speech. It may slow down and prices for certain things may decrease as supply rises to meet demand, but you shouldn’t be dormant with your cash but put it to work ASAP. Watch for a real estate correction this winter for a buying opportunity if you’ve been waiting. Don’t panic.

How To Preserve Your Assets During 1970’s Style Inflation?

So times have changed, but inflation is back. In the 1970’s prices went up 10% year over year due to a few things – in my opinion OPEC and the departure from the gold standard were the biggest reasons. During that time period you would have made out quite well if you kept all your cash in energy stocks and real estate investments. You’d also make out like a bandit holding gold and silver.

During this period I think the same is true, however there’s a few differences.

- Energy stocks now should include “Green Energy” companies and not just comprise of typical fossil fuel producers/ refiners.

- I’d focus more on residential real estate instead of commercial real estate especially if the commercial REITS are heavily invested in traditional office buildings and property in large metropolises.

- Gold and silver now have competition – cryptocurrencies led by bitcoin and etherium. Altcoins offer large APY yields to those who risk holding them and “staking” them or participating in defi programs. Bank interest rates are still abhorrently low, and at the time of writing this the best interest you can get on a savings is basically 0.5% with Ally unless you are using some promotion or something that requires you go through hoops. Defi can easily get you closer to 20%.

- One sector I’m willing to keep cash in is food producing companies and food sellers. That means Lamb Weston, Conagra, Archer-Daniels Midlands for the food producers and Albertsons and Walmart for the retailers. These companies make money off of an inelastic good, and for those who took economics that means that people can’t really stop buying regardless of the price. When it comes to low level luxury goods price elasticity means that demand goes down when price goes up, and for some goods this effect is stronger than others.

- Another sector that sells goods that are partially inelastic is energy, that means energy companies and I’d throw in green energy companies into this mix. Fuel is needed for heating during the winter and essential transportation year round.

- One winner of inflation that wasn’t around during the 1970’s could be the internet and internet based businesses. As people are too poor to go out, pay for fuel, and dine out they may turn to internet based entertainment such as we saw during Covid in mid 2020.

- Regarding real-estate, we did see a huge surge in price in the past few years as people moved around the country with the ability to work from home and the newfound realization that their life is finite due to the pandemic – we may see real estate prices keep up with inflation or slow down a bit, I think a slowdown is more likely as homeowners feel the strain of inflation and sell-offs start to happen. This will benefit people and corporations who have the means to buy up these properties and rent them out.

What not to do:

- Nothing – don’t do nothing. Take action to preserve your value that you’ve worked hard to build.

- Bank CD – if you lock your money into these low yield fixed rate certificates of deposits you are effectively throwing your money away.

- Keep all your money in Consumer Discretionary and related businesses stock. That means Footlocker, Texas Roadhouse, etc.

Is inflation “transitory”

- I don’t think so, I think it will slow down in the future but what you can buy for the dollar now will never buy you more in the future. I see inflation going up 5 to 10% for the next few years, and that is on the optimistic side.