Painful but necessary. I’m talking about the United States Federal spending. Instead of choosing constituent classes to give free money to that comes from the wider population, it’s time now to reduce spending across the board.

Start with Foreign Spending

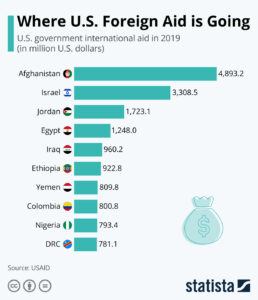

Starting with non-constituents, meaning foreign entities – foreign countries, organizations, etc. The Federal Government, whose job it is to represent US citizens, needs to reduce foreign aid spending.

There’s a really good website that breaks down foreign assistance by country called “ForeignAssistance.Gov” – it’s located at https://foreignassistance.gov/cd

You’ll find that four countries almost or exceeding a billion USD in US aid each year, including:

- Afghanistan

- Israel

- Jordan

- Egypt

- Iraq

- Ethiopia

- Yemen

- Columbia

- Nigeria

- Lebanon

Less USD in circulation means less spending and less inflation. Countries will learn to be self sufficient, and less needy on external income coming in to keep them going. If we’re lucky other foreign competitors will prop up these countries and deplete their own cash reserve. Regarding the Ukraine spending, the US is on track to donate almost 100 billion dollars. So far total US aid to Ukraine has been more than 68 billion. [1]

Without getting into whether the spending is “right” or “wrong”, I think it’s objectively fair to say we’re treating Ukraine better than we did the UK back in WW2. Back in WW2 at least we had the UK send us gold and create loans for the material we were sending over. A much more prudent policy that keeps American interests in view.

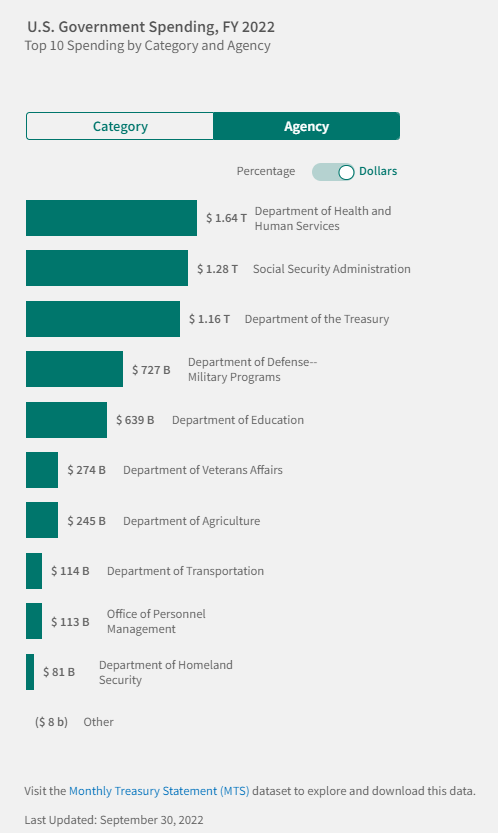

Domestic Spending

Social Security, Healthcare, and many branches of the Federal government spend a lot of money on non-essential workforce. Also, much of that money is spent towards pension plans that the rest of the economy does not have the luxury to have – you can check out more details about government pension eligibility here at https://www.opm.gov/retirement-center/fers-information/eligibility/. Long story short, as the size of government grows so does the residual costs. Unlike the free market, government agencies do not have to prove they are effective, as free market businesses do. They don’t even have to effectively carry out their mission, because there are no other competing agencies to compare against. At the state level, at least different states can compare their effectiveness in carrying out services against other states.

While it’s hard to simply say we need to cut Social Security and Medicare spending, or Military spending, it is a question that needs to be brought up. It’s a political landmine but I think what needs to happen is each of these behemoths need to be objectively inspected completely to ensure that wastage is kept to a minimum. I see technology and analytics as a good means of really proving out the effectiveness of these agencies each and every one.

Personal Spending

The US Government is probably not the only entity that needs to cut on spending. Readers should also consider cutting the fat if they can help it while staying sane.

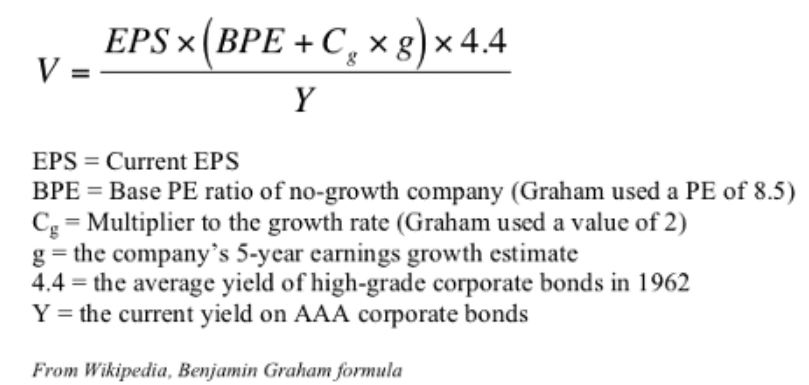

US personal spending is a double edged sword. Without a lot of domestic spending the economy will be damaged and there will be less money in circulation. However, increased domestic spending generally tends to result in higher prices because of more demand than supply. Higher inflation is the reason the Federal Reserve increased interest rates, and further interest rate increases will harm the stock market. While technically higher interest rates were long overdue, they come at a time when the economy and it’s companies are addicted to cheap loans. You will find that many of these companies that were overly dependent on this cheap money will start to go out of business.

What Should I Do?

For those reading this, I’d encourage you all to refrain from frivolous spending and continue to focus on spending money on assets rather than liabilities. Given the volatile nature of the stock market in relation to interest rates, I’d suggest holding a healthy chunk of cash in a high yield savings account. I’m currently getting 3.3% interest on my savings account holdings, and at least 2% cash back on credit card purchases. The Citi Double cash card gives me 2% back on everything and I use an Amex card to get 5% back on groceries. Spending less by choosing carefully where to shop adds up in the long run. Walk more and try to do activities that don’t require cash that are still fun.

My best guess estimate about when the stock market and real estate market start to gain ground again is when the Federal reserve stops raising interest rates and starts lowering them again – It may be late this year or may be up to three years from now.

Citations

[1] “Aid to Ukraine Explained in Six Charts.” Aid to Ukraine Explained in Six Charts | Center for Strategic and International Studies, 9 Jan. 2023, https://www.csis.org/analysis/aid-ukraine-explained-six-charts.