Well, it’s been about a year since my last post. A lot of things have changed for me, a new job with unique challenges and opportunities, an expanding family, and lastly a move from one state to another. That being said, I do feel like I’ve abandoned my subscribers and for that I’m sorry!

Now that that’s out of the way I’d like to recap for you what I think has happened so far this year and what you can do to situate yourself financially to make the best return on your investments.

Inflation

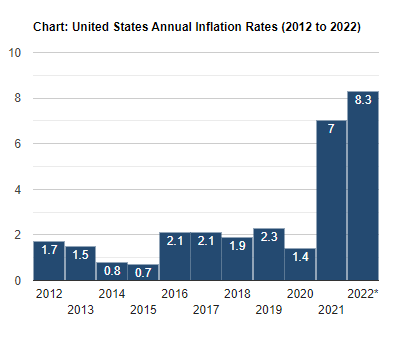

It’s become clear that the media and the political elite have really been shocked at the rate of inflation over the past couple years – the official numbers are drastically underreported yet are still shockingly high.

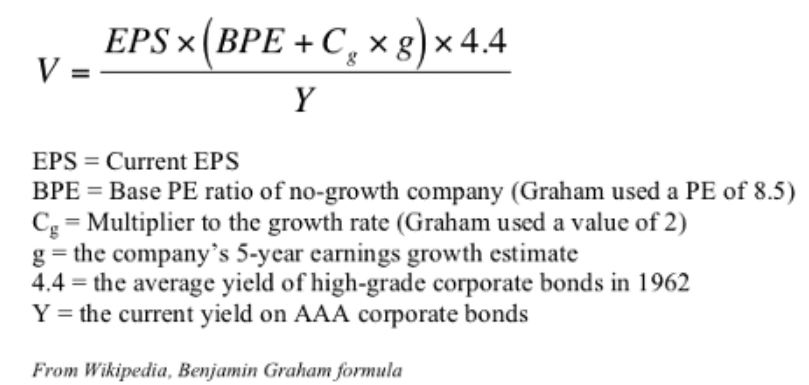

The chart and table below display annual US inflation rates for calendar years from 2000 and 2012 to 2022 ending in August 2022.

Now I have my own metrics of calculating inflation, that being the price of a Michelina’s frozen Entrée. You’ll find this in the freezer section of any major supermarket. Now I know the prices for these things had been $1 each for the longest time. Last year the price went to $1.30 and this year they cost $1.69 at the same place (Walmart). Other stores charge even more… So if you are gauging inflation based on food cost if you’re diet consisted only of these then the inflation rate is closer to 30%.

Michelina Frozen Entrees

Baby Boomers in Trouble

Now on a more serious note, of the around 72 million Baby Boomers in the US, the older spectrum are now in their early 70’s. The mandatory 401k Withdrawal age in 2022 is 72 (it used to be 70.5). That means we will start to see outflows from the largest population group in the US, and potentially more voluntary withdrawals as it doesn’t make sense to for Baby Boomers to hoard cash if they are in end of life stage. This means either the Federal Reserve is going to allow the stocks to be tanked by their higher interest rates and destroy the quality of life for millions of the older generation and make them reliant on government benefits OR go back to purchasing stocks and putting the brakes on interest rate hikes.

Quiet Quitting

The quiet quitting movement is here, and it’s loud. This is not just happening in the US but also throughout the world in developed or developing countries – in China this is called the “lie flat” movement. As someone who has been to Europe, this is already the norm in countries like Italy and France – but as it becomes normalized in the US and China the entire world could become less productive. Less productivity could result in higher prices for goods and services. As long as you’re in a position where you’re income can scale with inflation you should be ok, but for those that can’t it will be important to have job mobility. For retirees this is just a bad situation altogether.

What I’m Doing

Now to the meat of the article – what am I doing to situate myself where I’m not blown away by the coming events. First thing, I’m holding the stocks in good long term companies. My portfolio is heavier in defense, food production, and Apple stock. I see Apple as an industry in itself since it has put itself in a good position against companies who leeched off of people’s private data (I won’t name names and get demonetized). Secondly, Apple is second against none ever since it surpassed Intel in making the best phone processors. Lastly, Apple has tons of cash reserves in USD so a strong dollar isn’t as bad as you may think for this company. Food stocks have done pretty well since the war in Ukraine, same with defense stocks. Both of these are also things that people and governments will not stop spending money on. In fact, a larger proportion of money is spent on these sectors during times of world tension like we see today.

Less Discretionary Spending

You will not see me going near buying discretionary spending companies like Build a Bear with a 10 foot pole. In fact I have purchased put options on this and other frivolous retail companies. In times of depression you’ll still see a lot of people in supermarkets but very few people in Coach stores. Middle class luxury items are getting and will continue to get quashed for the next year at least in my opinion.

I’m also holding stock in Chevron, as energy prices stay high. The biggest risk to oil stocks are political actions against them by the current administration. They can pick winners and losers, and its a risk you have to evaluate as you hold companies that can be construed as controversial. If you went back 40 years ago you would probably not have believed if the government and regulations could kill the tobacco industry, but it happened. This time the focus is on fossil fuels – the recent conflicts and the necessity for energy has probably drawn attention away from these companies temporarily.

Preparing to Strike

Cash is important to hold in your portfolios, and people often call this “powder” for a reason, it gives you ammunition to get in when prices are routed in stocks and real estate. If real estate gets down to a level where I can reach my 1% to 2% rule on real estate returns I will probably buy another rental property. I will attempt to lock in a 30 year fixed rate but this all depends on what the mortgage and escrow costs are in comparison to my expected rental income.

Will I Keep Writing?

I’m hoping to write at least once a month from here on out. The major changes in my life didn’t need to put a stop to my posts, I just need to be more consistent. I’m still pretty active on my Facebook groups and pages.

References and Relevant Links