The status of the USD as the world’s reserve currency has been a cornerstone of the global economy for decades. However, recent geopolitical and economic developments have raised concerns that the era of the dollar may be coming to an end. The US has increasingly used its dominant position to impose sanctions on other countries, weaponizing the dollar in the process. This has led many nations to seek alternative means of conducting international trade, such as barter or using other currencies like the euro, yuan, or even cryptocurrencies. The trend is a worrying sign for the US economy and the global financial system as a whole, as it could lead to a loss of confidence in the dollar and trigger a crisis of confidence.

Changing geopolitical landscape: rivals and former allies moving away from the dollar

The situation is compounded by the changing geopolitical landscape. Countries such as Russia and China, which have traditionally been viewed as rivals to the US, are increasingly asserting themselves on the global stage, challenging American hegemony. At the same time, other nations, including former allies and neutrals, are also moving away from the dollar, seeking to protect themselves from the risks associated with its use as a weapon. India, for example, has been buying Russian oil and conducting transactions in rupees, while Saudi Arabia and Iran have cooperated with China as a mediator, bypassing the dollar altogether.

Ron Paul’s views on the matter are relevant here. He has long advocated for the US to stop instigating conflicts and to focus on mutual interests and trade rather than conflict over forms of government. By following these policies, Paul believes the US could have avoided the current situation, where many countries are seeking to move away from the dollar as the world’s reserve currency. If the US had pursued a more cooperative approach to international relations, it could have maintained the dollar’s dominance as the world’s reserve currency.

Consequences of a shift away from the dollar

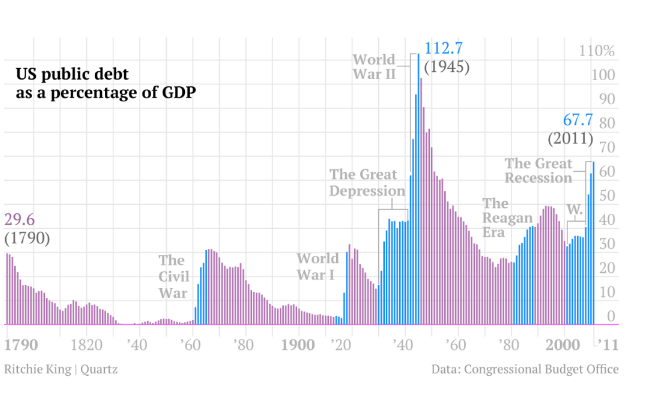

The consequences of a shift away from the dollar could be far-reaching. The US economy is heavily reliant on the dollar’s status as the world’s reserve currency, with around two-thirds of all foreign currency reserves held in dollars. A loss of confidence in the dollar could lead to a sharp decline in demand for US treasuries, making it more difficult and expensive for the government to borrow money. This could trigger a financial crisis, with ripple effects felt around the world. The US would also face a loss of influence on the global stage, as the dollar’s dominance has given it significant leverage in international affairs. The future of the dollar, therefore, is a matter of concern not just for the US but for the entire world.