“The principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale” -Thomas Jefferson

“Government debt is a system, not only ruinous while it lasts, but one that must soon fail and leave us destitute” – Abraham Lincoln

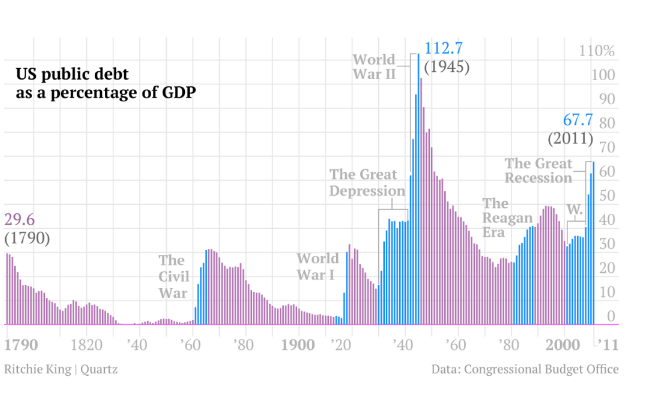

If you’ve graduated from university in the past 20 years most likely you’ve been taught that deficit spending is good for an economy, you’re also most likely aware that for the past 20 years that we’ve had consistent government deficit spending. The last time the government ran a surplus was between 1998 to 2001. Going back further the last surplus before 1998 was in 1969 when Nixon took office. The period between including the 70’s and 80’s the US experienced high inflation but on paper PPP per capita GDP also went up. If you look at the chart below the Federal Debt was still less than 60% of GDP throughout the 70’s and 80’s but as of the latest data reported at the end of 2020 we are currently at 127% Debt/GDP.

The last time the US has ever had this much Federal Debt was back in 1945, when the US had not only spend a lot of money on Roosevelt’s New Deal to get out of the Depression but also we had spent an enormous amount of money on bringing an end to WWII.

The US has disastrously mismanaged the COVD-19 crises and unfortunately had to pay a lot of money because of it. How many rounds of stimulus will be enough, or will this become the new normal? A major beneficiary of this stimulus has been the stock market and real estate has been buoyed by historically low interest rates. However I think our consumption economy may have rough seas ahead unless it can tackle a few issues:

- Tax Evasion by Mega-Corporations – Without getting too much into specifics large corporations have ways to avoid taxes, a luxury not available to smaller businesses. This is a double edged thorn because not only does it stifle competition but also it further contributes to a growing national debt. Add lobbyists to the equation and the little guy has his work cut out for him. Ironically for us the investor class it means we should “go with the flow” and make sure we are at least riding the wave of blue chips and the Silicon six to retirement.

- Boosting manufacturing – the US needs to produce goods especially high tech manufacturing so it does not become eclipsed by other countries. It needs to make sure it can make medicines and vaccines domestically as well as cutting edge semiconductors, batteries, and circuit printing. Even though Intel is I would say one generation behind other companies I think the US needs to focus on getting it and other manufacturers caught up with, for example, Taiwan and South Korea.

- Repair infrastructure that was built in the 60’s. A lot of the US, especially the power grid and train systems, are woefully out of date. Rather than just giving money away, expanding the idea of UBI, the US should emphasize infrastructure from roads, electricity, trains, hydroelectric, and nuclear energy. Solar panel construction should only be done after evaluating the carbon cost of production and disposal, as well as impact on local environments.

- The Suburbs. The Suburbs as a concept were well-intentioned, but common sense and other towns across the world show that it really makes more sense for people to live closer if not walking distance from where they work. Strictly regulated commercial vs residential zoning should be re-evaluated so that people don’t need to travel by car or by train for that matter for everyday life. I think this will become essential as populations grow and in the US as the dollar starts to lose its status as the reserve currency.

So in conclusion, the US has some time left to fix a few things before the Federal Debt becomes an issue too hard to handle. It needs to use the time it has leverage as the world’s reserve currency to put the value of the currency to good use to put us on solid ground going into the future. Other countries have been keeping our standard of living up by creating cheap goods and accepting US dollars for them even though they know we can create dollars out of thin air. The Federal Reserve should keep it’s interest rates low while this transition takes place so the Government Debt doesn’t spiral up to 200% of GDP. Banks should be vigilant as they dole out mortgages with low interest rates to avoid another massive real estate bubble.

Is this going to happen? Probably not. Another large scale event like Covid, such as a new war would really cause issues with our government debt and most likely also crash the stock market. Stagflation may be the new buzzword and everyone will be wishing they were holding gold or bitcoin instead of stocks.