Are you too scared to sell the stocks that have made over 50% in the past year or two? Is it because you want to hold off on cashing in and paying a heft amount of capital gains tax? How about doing what the big banks do, buy put options! Put options go up and make money if the price of a stock goes below a certain amount by a certain time. That means if you buy put options for your most profitable stocks you will be essentially locking in profits while not having to sell these stocks which might be paying dividends.

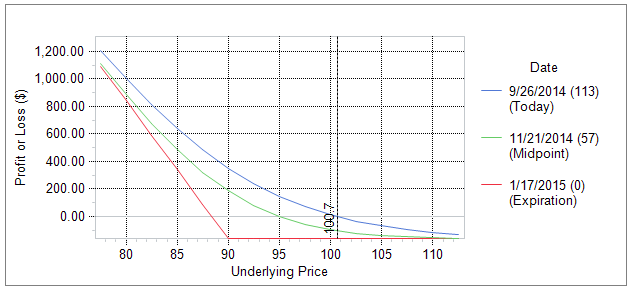

The downside with put options is you must pay a price to buy the put option from an available seller and put options expire based on what their expiration date is. The longer the expiration on a put the more expensive it will be. Let’s say you were lucky enough to be able to purchase Alibaba at IPO pricing – $68 per share. Currently BABA trades at $106, so you’ve made $38 per share, not too shabby. However, you foresee or have fear that BABA may fall below $100 and want to make sure you lock in those profits while not making a short term sell. What you can do is buy put options to cover your stocks until October 2015. Or if you want to save some money you could also buy put options now to cover you until March and then re-evaluate your “options”.

Options are cheaper than their underlying security because they are worthless if they aren’t “in the money” when they expire – to understand these options concepts if your a newbie please read this, this, or this.