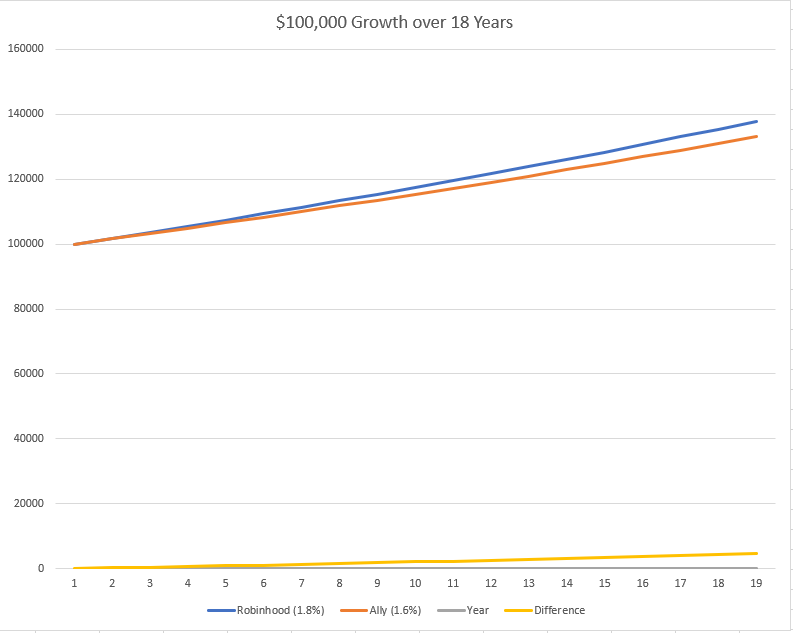

Robinhood’s New Cash Management Feature

Robinhood has introduced a new feature Cash Management which allows Robinhood users to save their extra cash in a high-yield account. Current rates for Ally Bank is only 1.6% (see below). Considering the main draw for Ally Savings bank was the interest rate (Ally has no physical walk-in bank), I can see a huge challenge approaching if Robinhood indeed keeps it’s interest rate at 0.2% higher than Ally Savings.

Adding insult to injury, Robinhood does not impose the transaction restrictions on its new account.

The only redeeming factor for Ally at this point is that Robinhood is releasing this slowly on a waiting list as it has done with features in the past.

Side by Side Comparison

Interest rate (most important)

- Robinhood Cash Management: 1.8% APY

- Ally Savings: 1.6% APY

Initial Deposit

- Both have $0.01 minimum requirement

FDIC Insured

- Both are FDIC Insured

Transactions

- Robinhood Cash Management comes with a debit card and no transaction restrictions (huge)

- Ally limits transactions to 6 per statement cycle

How to Get Robinhood?

You can use this link to join Robinhood. By using my referral code (included in the link) you will receive a free share as a signup bonus. Alternatively you can forgo the free share and go to Robinhood.com and figure it out from there. Good luck and best returns!