The statement “cheap does not mean cheap” has never been more meaningful. The first “cheap” means price relative to fixed amount say $100, and the second cheap means how much the stock costs relative to the value of the underlying company. A $1 stock might seem cheap to the inexperienced investor but a $100 stock might have a lot more value and be cheaper in relation to how much of a return you will be getting based on a company’s earnings.

Case in point – Advantage Oil & Gas Ltd is trading at just $4.59 , but it’s last reported earnings per share was just three cents! For those who know what P/E ratio is that would be a whopping 134.72. On the other hand, you might have a company like Chevron with a price of $108.21 but earning $10.86 per share while paying dividends of over a dollar per quarter! I would much rather choose Chevron over Advantage simply because the first is more of a gamble!

I think the biggest problem people have is that they think that a single or a few shares of an “expensive” stock is more risky, when in fact the opposite is true! See how investors in China are piling money into penny stocks, which might sustain itself if enough people keep joining in but most likely will result in a huge bust.

I’m not saying that high or no P/E ratio stocks should be ignored completely, however these types of securities are more risky than others. If you think there’s an upper bound on a share price you are wrong, as the $224,000 price for Berkshire Hathaway proves.

Using a stock filter, I have randomly chosen a few stocks that are ‘cheap’ under the layperson definition and ‘cheap’ under the investor definition. I will post their five and ten year performance below.

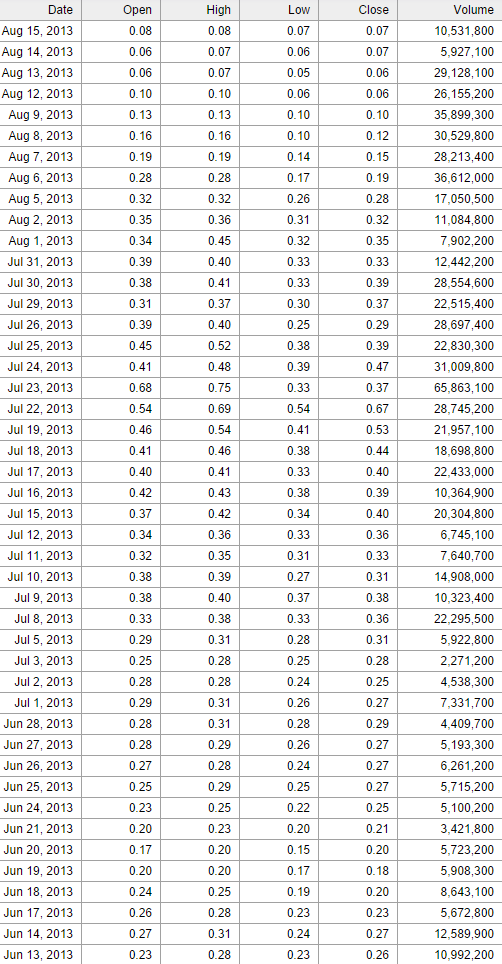

Cheap (dollar wise)

Of course, one of the reasons you might stumble across a cheap stock is because it’s price has already stumbled so much!

Helios and Matheson Analytics Inc – Perhaps the only good random pick, pays a 5% dividend but the price change has been disappointing in the past 5 years considering the rest of the market

Cheap (P/E ratio)

ACE Limited – Looks like a steady price increase, yielding almost 140% in the past 5 years on top of regular dividend payments.

Allstate Corp – 125% return on past 5 years along with regular dividends. Another winner in my book.

While there are thousands of more examples to go through, just a random selection of a few showed that the first version of cheap should have just been thrown in the trash and the second, intelligent, version is what you should be looking out for.

Good hunting!