To me it’s silly to ban bitcoin, but history and other countries have shown that banning a useful money that holds its value is often the course domineering governments take to meet their ends. China and India come to mind when it comes to banning cryptocurrencies or even certain higher denominations of their paper money. However, there is a spectre that other countries that are purportedly free market will also follow suit. This hard cutoff supposedly will coincide with the release of CBDC’s, or Central Bank Digital Currencies. If we want to see how this might play out it may be worth looking to the past.

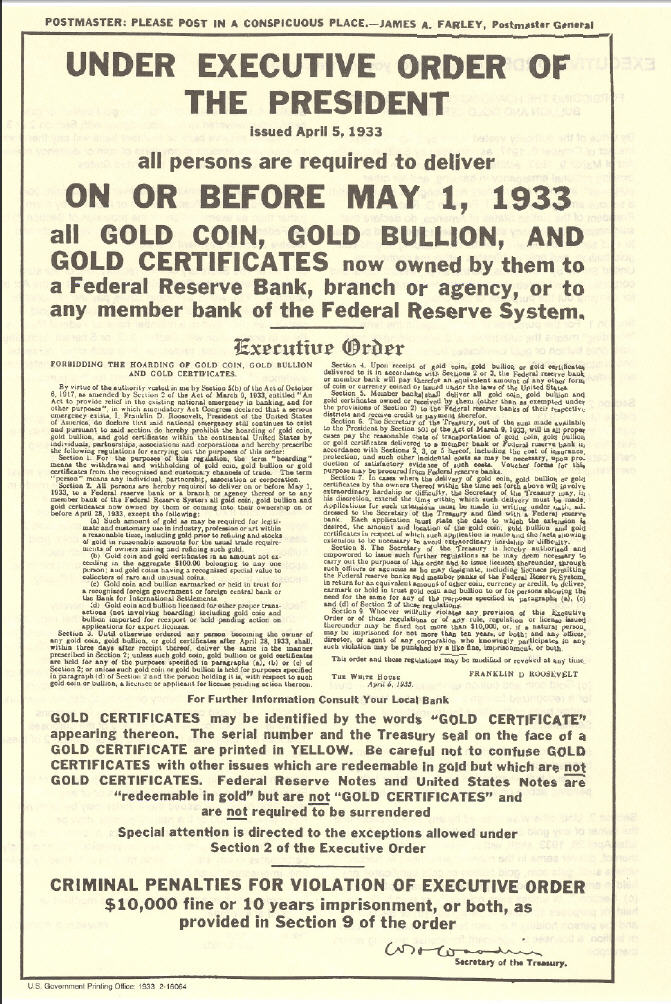

In 1933, four years into the Great Depression, FDR enacted executive order 6102 (image below) which required all persons to deliver on or before May 1, 1933, all but a small amount of gold coin, gold bullion, and gold certificates owned by them to the Federal Reserve in exchange for $20.67 per troy ounce. It would not be until 1974 that private citizens could once again own gold. The reason for this executive order was to stimulate the economy by being able to increase money supply which was at the time backed by a gold standard. By 1974, of course, the US was no longer really on a gold standard since three years earlier in 1971 Nixon permanently ceased the convertibility of the US dollar to gold by foreign countries. At that point the US had created way more dollars than it had gold to back them, and if all the dollars were redeemed for gold at their fixed price the point at which no more gold existed the financial system at the time would collapse. For those who held onto their gold either illegally or having had jewelry or numismatic coins (which were exempt from the confiscation in 1933), they would have seen the value rise tremendously – and most likely have been able to sell their gold in countries where it was not illegal to hold.

The same goes for bitcoin in the countries that have banned it. Online it is pretty easy to find someone who would be able to transfer money if you send bitcoin, and if you have a hardware wallet and didn’t want to transact online but needed to sell bitcoin one method is to leave the country to do so.

What is interesting to me is that bitcoin and cryptos are being targeted but real estate and other assets are not – wait, that’s not true either! Certain countries are cracking down on mom and pop real estate investors by now making it harder to get investment properties. This could be in the form of bans on owning over X amount of properties, or introducing new punitive taxes to discourage buying properties as investments. Now wait a second, stocks are still available to purchase, aren’t they? Yes, they are – and if inflation is 10% per year and your stocks go up 10% a year you are effectively keeping your net worth the same until you sell and pay taxes. What about gold? In the digital age of Amazon gold and silver, in my opinion, have been overlooked as stores of value. That being said, most young people would not accept gold/silver for cash since it is so foreign to them. They’d probably value an unopened bar or chocolate more than a silver bar (see video).

Ultimately, it will be a real test of Democracy and the free market to see which countries do not ban cryptocurrencies. Buying them is not being forced on anyone, and banning them will take away the hope millions have put into get themself closer to financial security or financial freedom.

I really hope the US does not go the way of more authoritarian countries in banning the future of money for their own hyperinflating unit that gets created in the trillions without the consent of the people who earn dollars for a living.